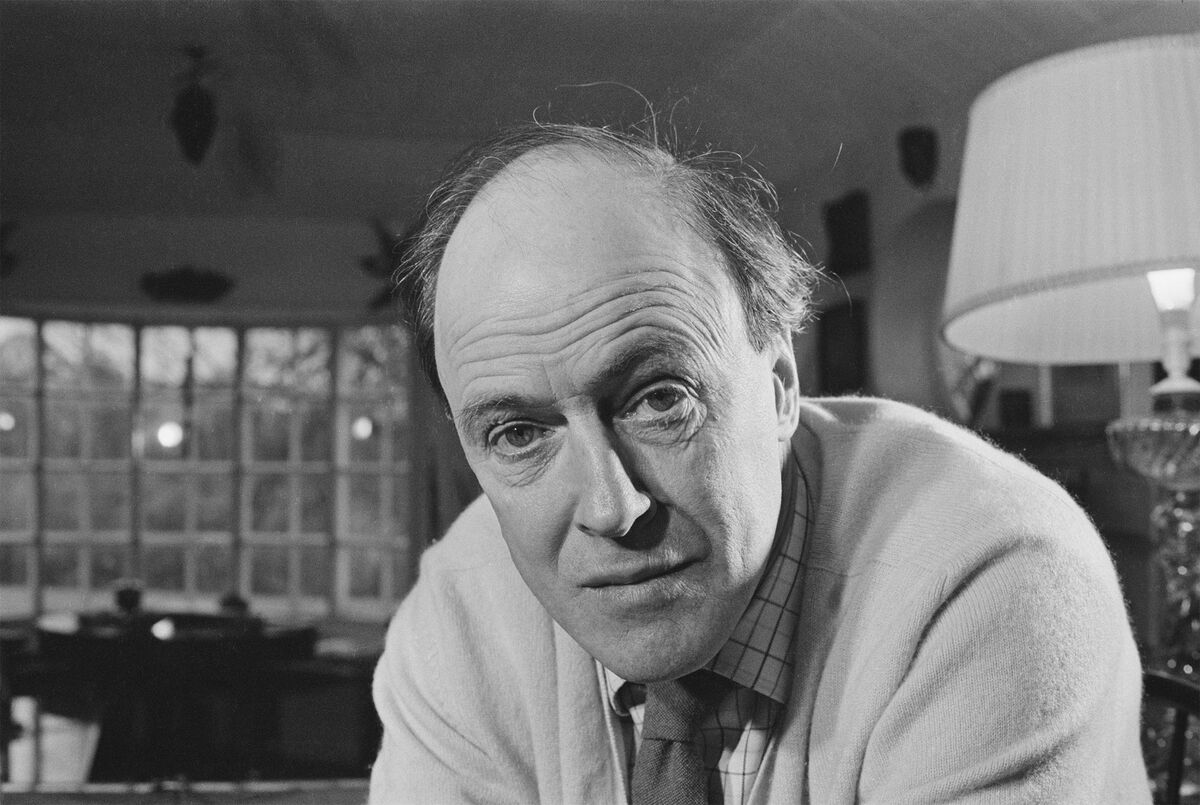

Netflix just made its biggest acquisition ever, agreeing to spend more than $700 million to buy Roald Dahl Story Co., which owns characters and creations like “Charlie and the Chocolate Factory” and “Matlida.”

Bankers have been pitching Netflix on acquisition targets for the past several years with little to show for it. The company acquired Millarworld, a boutique comic book publisher, and StoryBots, a kids’ media producer. Both of those deals were minuscule. This is Netflix’s version of buying MGM or Lucasfilm, albeit on a smaller scale.

So what changed?

On the one hand, not much. Dahl represents the exact type of company Netflix has always said it wants. It isn’t interested in buying a legacy media company with thousands of employees and infrastructure that doesn’t suit it. That means no TV networks or theatrical film distribution. It wants a company that owns intellectual property it can exploit for film and TV shows, and it wants a company with as little overhead as possible.

Dahl has a couple dozen employees, and controls the TV and film rights to a catalog of books that has sold more than 300 million copies worldwide. After many banks tried, the Raine Group got a deal done.

And yet, the Dahl deal does underscore two developments at the world’s largest TV network.

Its growing need to own strong intellectual property. Netflix thrived for years offering TV shows and movies created, marketed and released by other studios. Then it started making its own shows, but still relied on outside studios for many of those projects (like “The Crown”).

Netflix now wants to own shows from soup to nuts, both because many other companies have stopped selling to Netflix and because valuable IP is the foundation of the world’s largest entertainment businesses. Disney dominates the movie business because it acquired Marvel, Pixar and Lucasfilm. WarnerMedia’s biggest franchises are based on books (Harry Potter) and comic books (DC).

Netflix is now competing with these companies online, and it feels it needs some of its own intellectual property to stand out. Disney+ has managed to add more than 100 million customers thanks largely to a couple of original shows and library of classics.

Netflix said this week that it sees the Dahl company as the foundation a potential “universe,” a catalog that can be mined for several overlapping films and TV shows with similar aesthetics. It’s already commissioned filmmaker Taika Waititi to make a series based on “Charlie and the Chocolate Factory.”

Critics have pointed out that many Dahl properties have been adapted over the years, many of them recently. Warner Bros. is in the middle of developing a prequel to ‘Charlie and the Chocolate Factory,’ and would have seemed like a logical buyer for Dahl. (I’m told WarnerMedia did explore buying Dahl, though AT&T has done a lot more selling than buying of late.) But George Lucas’ recent "Star Wars” misfires didn’t stop Disney from eventually getting “The Mandalorian” out of the Lucasfilm library.

Dahl fits Netflix’s specific needs in a couple key ways. The books have a global appeal (or at least in several major markets). And many of them speak to kids, an area of programming where Netflix had had less success than many genres that cater to adults.

That brings us to the second key. Because the Dahl catalog caters to kids, it also has greater potential when it comes to consumer products, video games and in-person experiences, all growing priorities for the company as well.

Netflix doesn’t just want to exploit IP across movies and TV shows any more. Netflix said it has plans for “publishing, games, immersive experiences, live theatre, consumer products and more.” Don’t be surprised if it stages Wonka-branded carnivals or creates a “Matilda” backpack line.

The company has yet to prove itself in these areas. Toy manufacturers haven’t been impressed with Netflix’s ability to drive sales yet. But this is where Netflix would say it’s early days. It just hosted its first global fan event this past weekend, is going to make a bunch of announcements tied to shows like “Stranger Things” and “The Witcher” in the coming months. — Lucas Shaw

The best of Screentime (and other stuff)

Debunking a couple Hollywood myths

Netflix and Apple swept the top three awards at the Emmys last weekend, which is pretty funny when you consider how much time people in Hollywood spend criticizing both of those companies’ programming. There is a perception that the quality of Netflix’s programming has declined, and a perception that Apple has no idea what it’s doing in Hollywood.

There are flaws with both of these arguments.

Netflix has always offered a mix of quality and quantity. People must have forgotten that “Hemlock Grove” and “Marco Polo” were among Netflix’s first original series, or that it licensed shows from broadcast networks.

Netflix has since replicated the entire range of the cable bundle all over the world. Open up your app and scroll. Dating shows like “Love is Blind” sit alongside award-winning documentaries about street food and disability rights. It’s not as though Netflix stopped making good shows. But it’s as likely to serve you pulpy dramas “Outer Banks” and a Korean version of “The Hunger Games” as it is “The Chair” or “The Crown.”

The problem for Netflix, if there is one, is that other streaming services now offer comparable quality.

As for Apple… Talk to anyone who makes or sells programming, and they will still tell you that Apple is a studio in search of an identity. They like shows with stars, but there doesn’t seem to be any creative motivation beyond that. But this is where many in Hollywood and the press – myself included – betray their bias.

Entertainment isn’t foundational to Apple in the way it is to Netflix or Disney. It is a marketing tool, and a brand builder. It creates yet another reason for customers to think fondly of the company, or to buy one of its devices. It earns the company celebrity ambassadors. All of these are useful for a firm that, unlike some other technology companies, remains popular among customers. And that strategy seems to be working just fine.

Apple has enough money to keep playing in Hollywood and competing for top projects. It’s already got a couple of buzzy shows, which is more than some services can say right now. In time, it will have a lot more.

The No. 1 new sports TV show is…

ESPN’s “ManningCast.” The network is offering a second broadcast of “Monday Night Football” hosted by former NFL stars Peyton Manning and Eli Manning.

TV networks have tried creating secondary and tertiary broadcasts of live events for years now, sometimes just airing the same program on many networks and other times creating a football playoff game with a Nickelodeon splash zone. Sports networks have also tried to nurture more conversational broadcasts featuring big talent.

The ManningCast is both of those things, and unlike many of the previous efforts, this one works. The Manning brothers seem to be having a good time, offer a more informed perspective on the game than most broadcasts. The stellar reviews have already boosted the ratings. The second week telecast drew 1.86 million viewers, more than doubling the broadcast from week one.

What was that about Netflix and sports?

Every few weeks, someone asks Netflix’s co-CEOs about adding live sports, and every few weeks they say “no thank you, not interested.” So it was pretty jarring to read this week when co-founder/co-CEO Reed Hastings said Netflix would think about buying the rights to Formula One if they came up again.

This doesn’t mean Netflix is going to bid on NBA rights next year. Netflix still isn’t interested in regional rights to major sports. But it is interested in controlling global rights to a sport, especially when that sport is already the subject of a popular series (“F1: Drive to Survive”).

Has Hollywood lived up to its BLM promises?

Country star Morgan Wallen pledged $500,000 to Black-led groups after using a racial slur. But so far it appears only one organization has received any money from Wallen. This fits into a broader pattern of media companies (And really all companies) pledging money to support Black businesses after the George Floyd protests and then not delivering on its pledges.

Hollywood labor strife update

IATSE, the union representing thousands of Hollywood crew members, plans to vote to authorize a strike. That doesn’t mean a strike will happen. But it is a step in that direction. We should know more in the coming days.

Deals, deals, deals

Sony is trying to merge its Indian TV business with Zee, another leading broadcast business. The deal would create a new media giant in the world’s second biggest country.

The Sony-Zee union will compete with Disney for media rights to cricket, the most popular sport in the country. Sony had those rights until 2018 when Star (then part of Fox, now part of Disney) swiped them.

India is the one territory where Disney+ is far outpacing the streaming competition, and it’s largely because of cricket.

- The Athletic is trying to sell itself again. Despite two failed attempts, it is seeking $750 million.

- Barstool Sports is going to hit $200 million in sales this year.

- ESPN’s top NFL reporter has invested in a sports gambling company alongside one of the league’s owners.

- Apple banned Fortnite from its App Store until the legal dispute between the two of them is resolved.

Weekly playlist

I have fallen in love with Kari Faux, a rapper from Little Rock whose new album has a little bit of an Outkast/Run the Jewels feel.

I also went to the Hollywood Bowl for the second time in a week Friday night. St. Vincent puts on a hell of a live show.

"strategy" - Google News

September 27, 2021 at 05:00AM

https://ift.tt/3kJJTaq

Netflix's Biggest Deal Ever: A New Spin on the Same Strategy - Bloomberg

"strategy" - Google News

https://ift.tt/2Ys7QbK

https://ift.tt/2zRd1Yo

Bagikan Berita Ini

0 Response to "Netflix's Biggest Deal Ever: A New Spin on the Same Strategy - Bloomberg"

Post a Comment