onurdongel

Cognex (NASDAQ:CGNX) is a leader in machine vision and industrial barcode reading technology for automation. While the company is currently facing a number of challenges, Cognex has a bright future. The use of machine vision is likely to continue expanding in coming decades, driven by greater AI capabilities, rising labor costs and increased manufacturing requirements. In particular, the cost and capabilities of automation, machine vision and AI could be reaching a point where a far broader group of customers will begin adopting the technology. Cognex's new products and sales strategy target this broader group of customers, positioning the company for long-term growth.

Market

Cognex has had a difficult 18 months on the back of higher interest rates, macro weakness in China and Europe, and a pandemic demand hangover. While these conditions still generally persist, Cognex has suggested that the demand environment is stable.

Consumer electronics continues to face the most headwinds due to soft consumer demand, with China an area of particular weakness. Customers are also cautious in regard to automation investments. Longer term, smartphones, wearable devices and new technologies should drive growth, with manufacturing automation necessary to improve cost and quality.

Cognex’s logistics business grew both YoY and sequentially, although management has stated that demand remains near the trough. In particular, large ecommerce players are still working their way through excess capacity from the pandemic. Ecommerce penetration is slowly returning to the pre-pandemic trend though, which should result in stronger conditions at some point in the not-too-distant future. Cognex remains optimistic about its logistics business longer term, with its products increasingly able to address new use cases and the problems of smaller customers. Developing markets also remain a large growth opportunity.

Figure 1: Ecommerce Penetration (source: Shopify)

EV batteries continue to be a growth driver for Cognex, with many vendors expecting to increase their production capacity 5-7x by the end of the decade. Machine vision is an important technology for battery manufacturing in terms of its impact on quality, throughput and safety. This positive outlook is tempered by the fact that there is overcapacity in China, which has led to a slowdown in investment there. Chinese manufacturers could also flood international markets with supply, depressing investment in capacity globally.

AI and Automation

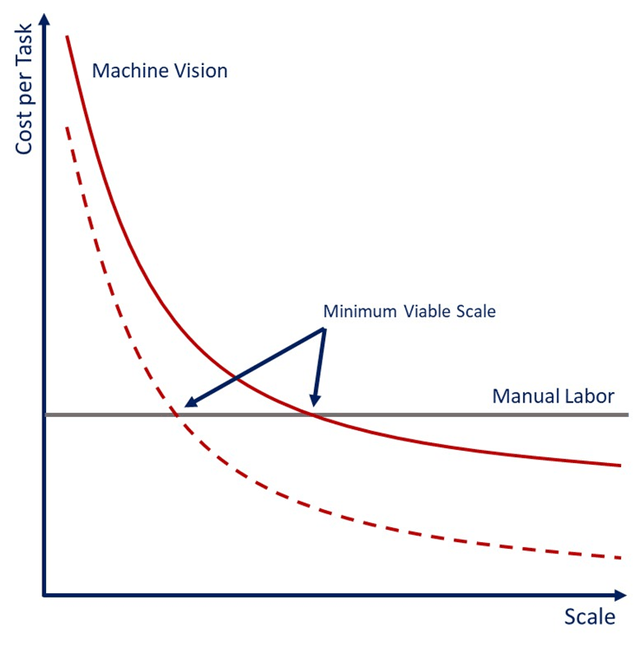

I think this paper provides a useful framework for thinking about Cognex's business. While computer vision has a lot of potential, adoption is hindered by limitations of the technology and the high upfront costs. As the technology improves and costs drop, more use cases are enabled. Technology has so far only been able to automate a relatively small number of tasks, but the pace of innovation suggests that this could change in coming years. Horizontal platforms, like Cognex, also support the adoption of machine vision by spreading technology development costs across a broad range of firms.

Figure 2: Illustrative Minimum Viable Scale for Machine Vision (source: Created by author)

Cognex

Cognex recently entered two adjacent end markets, vision sensors and optical components, which expand its opportunity by 1.5 billion USD.

SnAPP

The In-Sight SnAPP vision sensor was launched in September 2023 with the goal of democratizing access to machine vision for quality control. In-Sight SnAPP is powered by pre-trained AI and guides users through the setup process, making it easy to use. It does not require any programming or vision knowledge by the user.

In-Sight SnAPP is an entry level product, offered at a lower price point, which could then act as a steppingstone to more powerful vision systems. Cognex believes that this will allow it to reach a wider customer base, leveraging the company’s emerging customer sales force.

Moritex

The high-end optical components market provides a 500 million USD opportunity. Cognex entered this market through the acquisition of Moritex, a Japanese optical component vendor. Moritex provides optical components to manufacturers of semiconductor, automotive, and electronics capital equipment.

In the past, Cognex's customers have generally utilized third-party lenses and lights for image acquisition. Cognex began to invest more in optics in recent years, including its proprietary liquid lenses and computational lighting from the acquisition of SAC. Cognex now appears to view optical components as a more strategically important capability, worthy of vertical integration. This could be because improved imaging hardware leads to better images and improved machine vision tool performance. The acquisition also increases Cognex's exposure to the relatively important Japanese market.

Cognex expects Moritex to account for 6-8% of its revenue. Moritex's heavy exposure to electronics and semiconductors has negatively impacted its recent growth, but Cognex believes it can take market share and achieve 15% annual growth in the long term. Moritex’s gross profit margins are slightly lower (~50%) than Cognex’s but its operating profit margins are in line with Cognex’s targets (~30%).

Emerging Customer Initiative

Penetrating smaller or less technically sophisticated customers is a strategic priority for Cognex. The company wants to provide easy to deploy automation solutions to this customer segment to accelerate adoption. While this initiative is nascent, Cognex is pleased with progress so far and believes this segment could increase its customer base by up to 10x. While the revenue impact will be far smaller than this, it should still be a significant growth opportunity provided that Cognex gets the technology and distribution right.

To support this, Cognex is in the process of scaling its sales force. It has completed hiring for its emerging customer initiative in 2023 and many of the initial hires are now in the final stages of training.

Financial Analysis

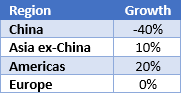

Cognex's revenue was down 6% YoY in the third quarter to approximately 197 million USD. This decline was driven by consumer electronics and semiconductors, with logistics, automotive and consumer products revenue up YoY. This was in part due to easy comparisons related to disruptions caused by a fire in 2022. China continues to be a large headwind, but this was largely offset in the third quarter by solid growth in the Americas and Asia ex-China.

Table 1: Cognex Revenue Growth by Region (source: Created by author using data from Cognex)

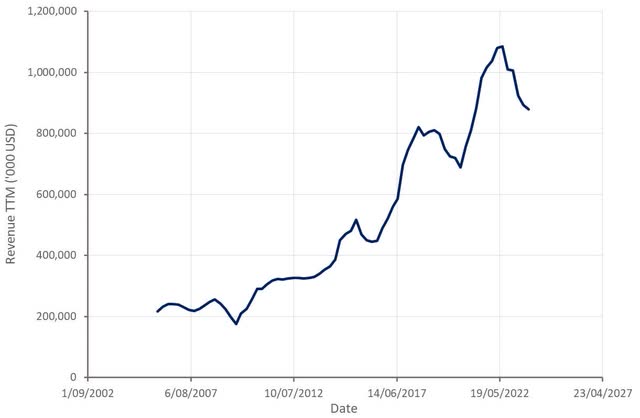

Cognex expects 175-195 million USD revenue in the fourth quarter, which will be aided by the inclusion of six weeks of operating results from Moritex. Cognex expects this to result in a 5-7 million USD boost to revenue. As a result, YoY growth is expected to be approximately -23%, or -25% excluding the impact of Moritex.

Figure 3: Cognex Revenue (source: Created by author using data from Cognex)

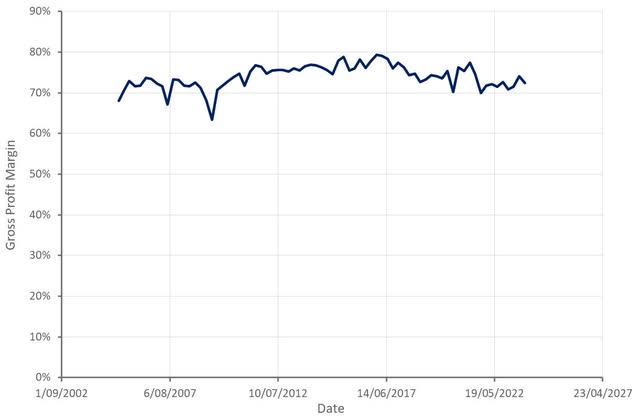

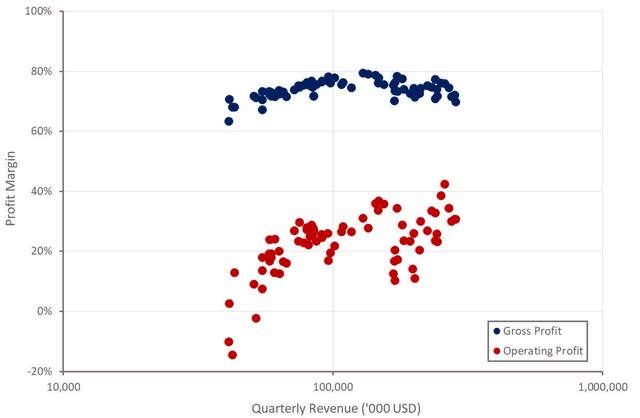

Cognex's gross profit margin has been fairly stable in recent quarters, with fluctuations largely due to product and industry mix and volume deleverage. Cognex is beginning to see price reduction flow through to its input components, but this isn't expected to hit the income statement for some time. Moritex will be a minor gross margin headwind going forward while the impact of the emerging customer initiative is not clear yet.

Figure 4: Cognex Gross Profit Margin (source: Created by author using data from Cognex)

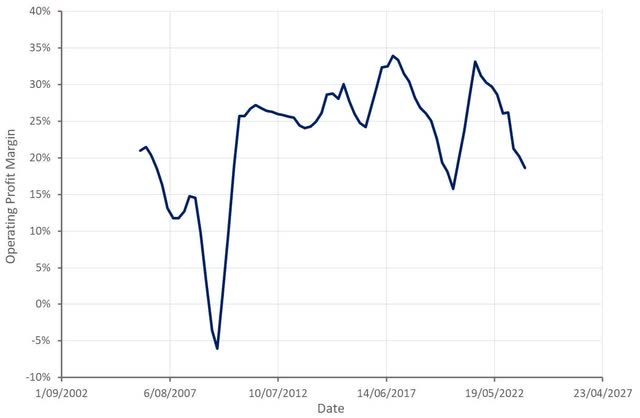

Cognex's operating profitability has dropped significantly in recent quarters, in large part due to its revenue declining. Cognex's emerging customer initiative and transaction costs related to the acquisition of Moritex were also a headwind in the third quarter. Moritex's operating profit margin is reportedly around 30%, and hence the acquisition should provide a margin boost going forward. The emerging customer initiative is likely to continue weighing on margins going forward, although this investment should begin to yield results in 2024.

Figure 5: Cognex Operating Profit Margin (source: Created by author using data from Cognex)

While the recent drop in profitability appears concerning, it is likely a temporary stumble caused by difficult market conditions. Cognex has a high margin business that has demonstrated operating leverage over a long period of time.

Figure 6: Cognex Profit Margins (source: Created by author using data from Cognex)

Conclusion

Investors must weigh the fact that Cognex has a solid business with a bright future against the ongoing challenges the company is facing. Revenue could continue to decline in the near-term and margins are likely to compress further. The market is likely to look through this weakness if the macro-outlook becomes less uncertain though. Cognex's valuation has declined significantly on the back of recent headwinds, but the stock is still a long way from value territory. Despite this, if Cognex meets its long-term targets the stock should generate annual returns in the high teens.

Figure 7: Cognex EV/S Multiple (source: Seeking Alpha)

"strategy" - Google News

January 24, 2024 at 05:34AM

https://ift.tt/nHg8e4X

Cognex: Visionary Strategy (NASDAQ:CGNX) - Seeking Alpha

"strategy" - Google News

https://ift.tt/gCwexK5

https://ift.tt/Ow9AIR0

Bagikan Berita Ini

0 Response to "Cognex: Visionary Strategy (NASDAQ:CGNX) - Seeking Alpha"

Post a Comment