After an 18-month review, the Fed announced changes Thursday to its long-term strategy that are designed to help the central bank meet long-elusive inflation goals.

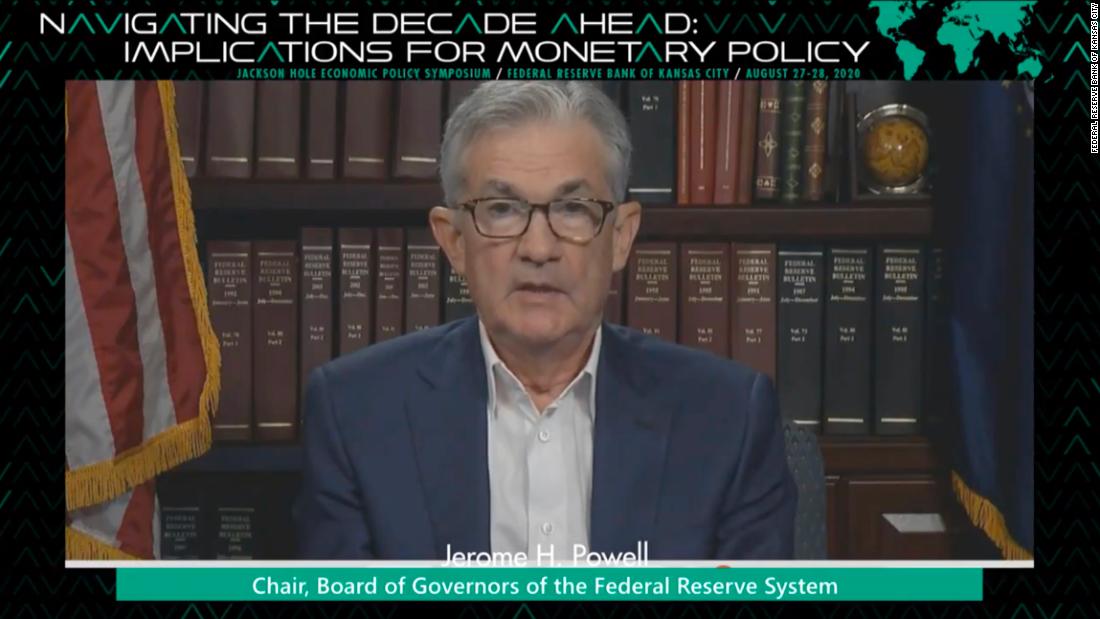

The new strategy, unexpectedly laid out in detail in a speech by Fed chief Jerome Powell, declares that the central bank will now seek to achieve inflation that average 2% over time.

That means after periods of low-inflation -- such as the dozen years following the Great Recession -- the Fed will allow inflation to run hot by climbing above 2%.

The Fed is once again signaling that it won't be in a rush to lift interest rates off the basement -- even if inflation starts to pick up as the United States recovers from the pandemic.

The shifts underscore the Fed's fears of tumbling into a deflationary spiral of ever-lower inflation like what Japan has experienced. Central banks have struggled to reverse such cycles because they become self-fulfilling prophesies. Once people expect prices to fall, they hold off on purchases until they do. It is especially difficult to recover from deflation when interest rates are already at zero -- like they are today in the United States.

"We have seen this adverse dynamic play out in other major economies around the world and have learned that once it sets in, it can be very difficult to overcome," Powell said in the speech. "We want to do what we can to prevent such a dynamic from happening here."

The new strategy by the Fed formalizes steps the central bank has already been taking, especially during the recession, to breathe life into the economy. Fed watchers had expected the new framework would not get laid out in detail until September.

Fed wants to boost jobs in low-income communities

At the same time, the Fed is making new efforts to target America's inequality problem. The gap between rich and poor has widened in recent decades -- a problem that threatens to lead to periods of instability.

The Fed's new strategy emphasizes that its mandate to achieve maximum employment is a "broad-based and inclusive goal."

"This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities," Powell said.

The Fed also said its decisions will be based on fixing "shortfalls of employment from its maximum level."

The new strategy highlights a realization among many economists that, because of aging demographics and other factors, the United States can enjoy both low unemployment and muted inflation. They point to the 50-year low in unemployment prior to the pandemic that coincided with low inflation.

"This change may appear subtle, but it reflects our view that a robust job market can be sustained without causing an outbreak of inflation," Powell said.

Yet the Fed stopped short of embracing a numerical goal, such as 5% unemployment. Powell said the Fed believes that would be "unwise" because the level of maximum employment is "not directly measurable and changes over time."

Bubble fears

The makeover to the Fed's strategy is being closely watched by Wall Street because the central bank's tactics have a huge impact on financial markets.

The Fed's easy money policies during the pandemic have set off a boom in the stock market, which is at record highs. Some critics worry the Fed is inadvertently inflating stock prices to unsustainable levels.

Powell emphasized, however, that although the Fed is focused on preventing deflation, it will act aggressively if the economy overheats and needs to be cooled off to prevent runaway inflation.

"If excessive inflationary pressures were to build or inflation expectations were to ratchet above levels consistent with our goal, we would not hesitate to act," Powell said.

Who wants higher prices anyway?

Critics argue the Fed's obsession with generating 2% inflation is misplaced.

Peter Boockvar, chief investment officer at Bleakley Advisory Group, argued in a note to clients Thursday that the Fed's preferred measures of inflation are "flawed" because they are dragged down by healthcare costs that are largely fixed by the government through Medicare and Medicaid. He pointed out that average core consumer prices is exactly 2% since 2000.

Few Americans complained this spring when prices on everything from gasoline to food and airfare tumbled. Yet rising prices would be greeted by groans by many people, especially those out of work or dealing with wage cuts.

"Letting inflation run above 2% for a period of time hurts the ... least-able to afford it. In other words, LOWER real wages is a growth depressant," Boockvar wrote.

The Fed acknowledged these challenges.

"We are certainly mindful that higher prices for essential items, such as food, gasoline, and shelter, add to the burdens faced by many families, especially those struggling with lost jobs and incomes," Powell said. "However, inflation that is persistently too low can pose serious risks to the economy."

"strategy" - Google News

August 27, 2020 at 09:09PM

https://ift.tt/2QuJWHb

The Fed's new strategy could keep rates low for longer than you think - CNN

"strategy" - Google News

https://ift.tt/2Ys7QbK

https://ift.tt/2zRd1Yo

Bagikan Berita Ini

0 Response to "The Fed's new strategy could keep rates low for longer than you think - CNN"

Post a Comment