Joshua Lott

The Initial SPY Sell Rating

I issued my first public sell rating on SPDR S&P 500 Trust ETF (NYSEARCA:SPY) on March 25th, 2022, with the S&P 500 (SP500) near the 4600 level. At the time, I recognized that the Fed would be forced to fight inflation which, based on the historical evidence, would eventually cause a recession, and the recessionary bear market.

However, I also later recognized that the Fed was unwilling to push as hard as it needed to fight the surging inflation, and in May/June I covered the shorts and went long S&P 500 expecting at least a decent summer rally. However, in mid-August after the sharp summer rally, I went short again, recognizing that the Fed would have to be much more aggressive, which in-fact Jerome Powell confirmed at the Jackson Hole speech.

The October "bottom" and the change of strategy

The September selloff led to the new lows in October and the visit to the key long-term support for S&P 500 at 200wma, which was actually broken on intraday basis.

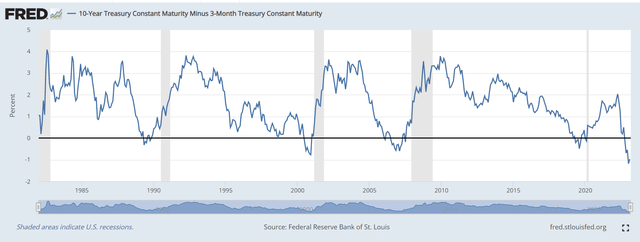

The fact that we were near the key long term support suggested that we could see another rally, or the end-of-the year rally. Further, I pointed out that shelter prices were falling, and that the Fed would have to signal the slowdown in interest rate hikes. Thus, I started to build a long position. However, at the same time the 10Y-3mo yield curve inverted, and the expected recession, in my view, got much closer. Thus, I abandoned the plans for to play the end-of-the year rally - since it was purely a technical speculative play, unlike the summer rally which had some fundamental support.

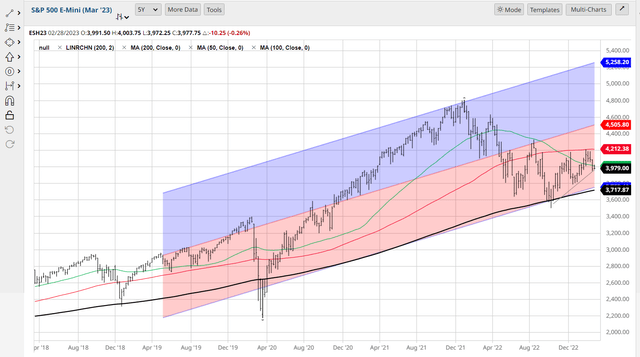

However, given the risks of the technical bounce, playing the market from the short position was appropriate at this point by selling the out of money naked calls, with Dec 22 and later Dec 23 expirations. The chart below illustrates the strategy.

This is the S&P 500 5-year chart, which shows the key 200-week moving average support (black line) and the 100-week moving average resistance (red line), with the corresponding range of approximately 3700 and 4200. Well, despite the bullish and bearish calls, S&P 500 has been "stuck" in this range.

The recessionary bear market (that I expect) will likely resume with the 200wma breakdown. At the same time the new bull market, as same expect, could likely be triggered by the 100wma breakout.

Thus, given my short bias, selling December (first 2022 and after 2023) call options with the strike prices at 4300 and 4400 has been a strategy that worked well. The December 2022 call expired worthless out of money for a maximum profit, while the December 2023 calls depreciated considerably as the S&P 500 has been stuck in the range.

Ove the near term, the break below the 50wma (green line), which is approximately where the 200dma is at the level around 3940, will likely lead to the selloff to the 200wma support at 3717. At that point, these December call options are likely to depreciate significantly to be covered, at which point we can re-evaluate directly shorting the bear market breakdown to the 2800 target. Similarly, the breakout above 4200 requires risk management, and thus, the conversion of the uncovered calls to the covered calls, especially if the breakout is fundamentally supported.

On the other hand, as long as S&P 500 remains in the 3700-4200 range, these call options are likely to slowly decay in value, which also works fine while waiting for the next move.

Barchart

The Current SPY Sell Rating

The strategy above is a tactical strategy involving selling naked option, and thus, it's inappropriate for most investors. Thus, I do not recommend this strategy for the regular investors.

However, I have been warning that the SPY is currently overvalued, with the forward PE ratio at 18, facing what is likely to be a much deeper and longer recession that most expect.

Here is the different chart, that almost everybody has seen by now, the spread between the 10Y Treasury Bond and 3-Month Treasury Bill. As you can see, it is deeply inverted - and that has led to a recession in prior cycles.

What does this really mean? It means that banks, who borrow at short term maturity and lend at longer term maturity, are going to tighten the lending standards. In fact, this is happening already. In a credit-driven economy this translates into a recession - as simple as that. Consequently, that also translates into lower corporate earnings - and a recessionary selloff.

FRED

So, the sell rating on SPY applies for somebody who needs to (or wants to) avoid the sharp 20-40% selloff from these levels. You never know what could happen next, once the recessionary bear market starts. The US is now deeply politically divided, and it might be more difficult to pass any corporate bailouts if needed (like in 2008). The geopolitical situation is extremely worrisome, and it will definitely be more difficult to implement a global stimulus (like in 2008).

Thus, to play it safe, it might be appropriate for some investors to shift from stocks to short term Treasuries yielding 5%+ while waiting for some resolution of the current bear market dynamics.

Long term investors, who trust that the future will be as bright as the past was, should probably ride this storm out and remain fully invested.

SPY Sector analysis

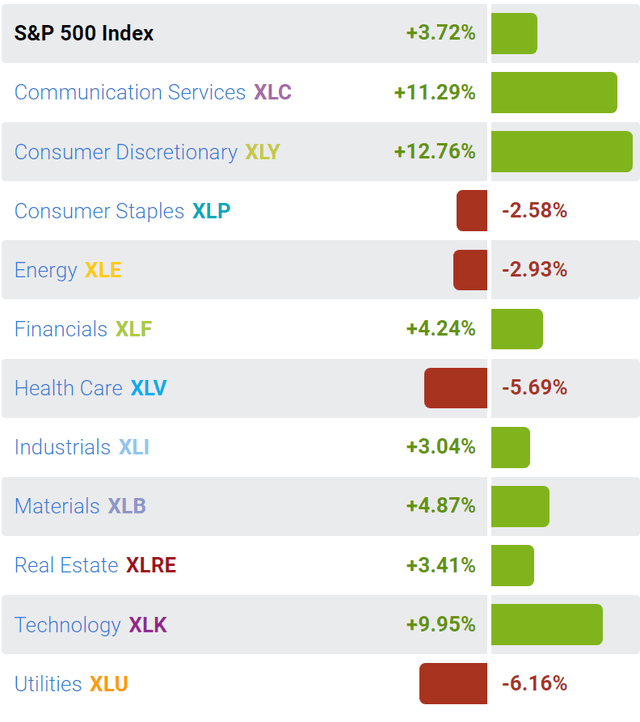

SPY is up YTD by 3.72%. But if you look at what sectors are outperforming, you will realize that the current leadership is clearly unsustainable. SPY has been led YTD by Discretionary sector XLY (12.76%), Communications XLC (11.29%) and Technology XLK (9.95%). These are cyclical high-beta sectors and completely inappropriate in a pre-recession environment.

SelectSecotorSPDR

Implications

The stock market, as proxied by SPY, has been frustrating for bull and bears, being "stuck" in the range. There are tactical strategies that work well in such environment, as I explained in this article. However, at this point, given the high probability of a recession, high SPY valuations, and unsustainable sector leadership, my recommendation is still a sell.

"strategy" - Google News

March 01, 2023 at 11:58AM

https://ift.tt/PoQCSwy

SPY: This Bearish Strategy Has Been Working (Technical Analysis) - Seeking Alpha

"strategy" - Google News

https://ift.tt/7RSHy4z

https://ift.tt/KFAf2Po

Bagikan Berita Ini

0 Response to "SPY: This Bearish Strategy Has Been Working (Technical Analysis) - Seeking Alpha"

Post a Comment