Jaromir Ondra

As most of you know, oil withdrawals from the U.S. Strategic Petroleum Reserve - along with coordinated releases by other member countries of the International Energy Agency ("IEA") - were used by the Biden Administration to mitigate the impact of Russia's invasion of Ukraine on global oil supply and the resulting pain-at-the-pump consumers felt along with that, and related high inflation across the economy. Today, I'll take a closer look at the SPR and whether or not President Biden's strategy was a success. I'll also discuss whether or not the SPR today is nearly as "strategic" as it was in the late 1970s/early 1980s when it went into operation.

The SPR

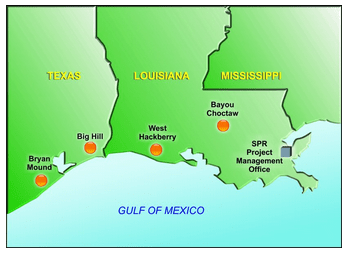

U.S. Department of Energy

As shown in the graphic above, the SPR's oil reserves are stored in four large underground salt caverns - two in Louisiana and two in Texas. In aggregate, these sites have a combined authorized storage capacity of 714 million bbls:

- Bayou Choctaw - an authorized storage capacity of 76.0 million barrels.

- West Hackberry - an authorized storage capacity of 220.4 million barrels.

- Big Hill - an authorized storage capacity of 170.0 million barrels.

- Bryan Mound - an authorized storage capacity of 247.1 million barrels.

The underlying mechanism used to move oil in and out of the SPR salt caverns relies on the fact that oil floats on water. That being the case, withdrawing oil from the SPR is as simple as pumping fresh water into the bottom of a cavern. That effectively forces crude oil to the surface where pipeline connections can transport it to terminals and refineries around the nation (but typically to those along the Gulf Coast nearest to the caverns themselves).

The "Biden Drawdown"

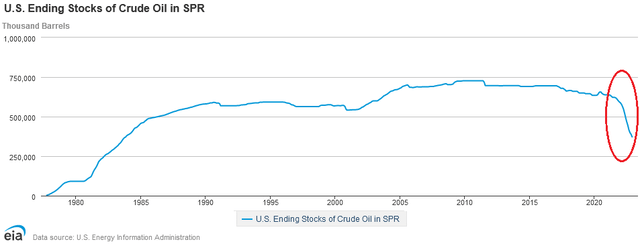

While the SPR level had been mildly declining for years, the significant draw-down in the SPR began in earnest right after Russia invaded Ukraine in February of 2022. That's noted by the red oval (added by the author) below:

EIA

That was necessary because the invasion, and the subsequent sanctions placed on Russia by America and its democratic and NATO allies, resulted in Russia weaponizing natural gas supply by shutting down the big pipelines serving the EU. That effectively broke the global energy supply chain - a global supply chain that has since been almost totally reconfigured. At this point, I doubt the EU will ever trust Russian oil and gas supply again - at least not as long as Putin and the current regime is in charge.

Regardless, data from the EIA indicate the SPR held 578.9 million bbls in February of last year when the invasion began and ended 2022 with 372.0 million bbls. That indicates withdrawals of 206.9 million bbls over that time span - or a reduction of an estimated 35.7%. Even worse, say Biden's critics, the SPR is now down to only 29% of its authorized capacity.

That caused many energy analysts and right-leaning politicians to run around with their hair-on-fire and warn of impending doom because the U.S. was somehow at grave risk due to an SPR drawdown to levels not seen since the early 1980s. I certainly agree with the levels observation, after all - that is simply an easily verifiably fact (like the graphic above).

However, the "doom" scenario was (and still is ...) way off base in my opinion (see reasoning below). But in an age where false narratives can quickly grab headlines on social media, many otherwise unknowing investors bought in to what in some quarters was a very popular line of thought. The same was true regarding the EU: Its member nations were supposedly going totally freeze last winter due to its pivot to renewables. That turned out to be a false narrative as well (not to mention that what got the EU in trouble in the first place was obviously its dependence on fossil fuels supplies from Russia, not renewables).

See my recent Seeking Alpha article The Demise of NYMEX Gas on why the EU was able to make it through the winter (Hint: we live in a new "Age of Energy Abundance" and shale is still "short cycle" regardless of what some self-serving politicians and energy companies CEOs are saying). Indeed, note that The United States Natural Gas ETF (UNG) is currently trading down another 15% since that article was published on Seeking Alpha two weeks ago.

But let's get back to looking deeper into the SPR withdrawal issue to see why the popular "doomsday" scenario narrative proved to be false.

Was The Release Strategy A Success?

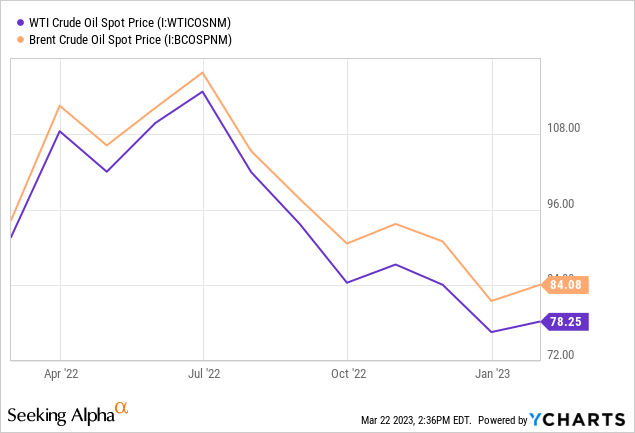

I suppose the primary factor to consider as to whether or not the withdrawal strategy was a success is simply the price action of WTI and Brent from Feb. 24 of last year to the present:

As can be seen in the graphic, the price of both benchmarks spiked sharply directly after the invasion - both going over $120/bbl. However, as the graphic also shows, since their peaks the prices of both benchmarks went straight down from July to October and have generally continued to trend lower to the current price. Today WTI is trading $13/bbl lower than it was prior to the invasion ($91.60/bbl). Note also that the relative Brent/WTI discount largely remained intact over the past year, but point out that the current spread (~$6/bbl) is actually wider than it was at the beginning of the invasion. That's an added bonus for American drivers as compared to the rest-of-the-world consumers.

Indeed, the price of gasoline in the U.S. has dropped by more than $1/gallon since the SPR began releasing oil onto the market directly after the invasion.

Meantime, the average price the Department of Energy received for the SPR bbls withdrawn was $96/bbl. That is ~$25/bbl higher than the price of WTI today.

Now, I'm not what sure what defines "success" in the eyes of Biden's detractors (if anything ...), but an objective analysis would have to conclude that - at least so far - the "Biden withdrawal" has certainly been successful from an economic point of view. Unless of course, you happen to buy into the politicians that set their hair-on-fire and apparently wanted oil and gasoline prices to stay high so that American consumers would continue to suffer from Putin's invasion and would continue to fan the inflation fire that those same politicians were also complaining about. It's impossible for me to square that kind of circular "logic," but that doesn't keep others from grabbing headlines and continuing to try to push that narrative.

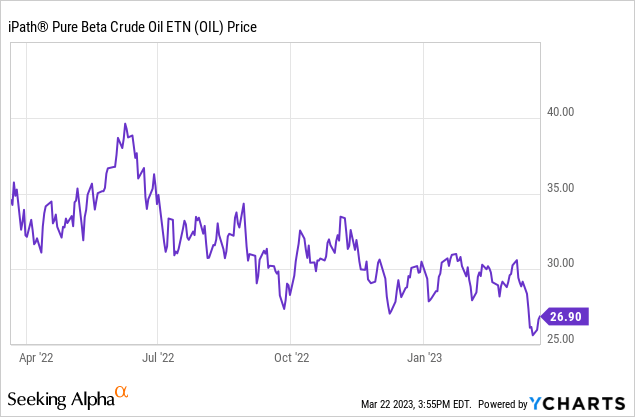

Meantime, note the iPath Pure Beta Crude Oil ETN (NYSEARCA:OIL) is down 24% over the past year:

Refilling the SPR

Last October, the Biden administration announced its plan to refill the SPR and encourage domestic production by putting a floor under the price:

... the President is announcing that the Administration intends to repurchase crude oil for the SPR when prices are at or below about $67-$72 per barrel ...

The current WTI price at pixel time is $70.80/bbl, which is certainly within the buyback range. As a result, the DOE announced in December that it began repurchasing oil to refill the SPR starting with 3 million bbls purchased at fixed prices. Reuters reported those deliveries were expected in February (i.e. last month) after locking in "fixed bids" from suppliers. It takes some time for SPR withdrawals and additions to be reported through the system, so let's not jump to conclusions until we actually see the SPR level rise.

Still, that's only 3 million bbls out of the 180 million bbls due to the "Biden drawdown". (NOTE: the balance was due Congressional mandated releases as a result of the Bipartisan Budget Act of 2015). So, there's still a long way to go and it is much easier to make withdrawals from the SPR as compared to refilling it. While so far the "Biden withdrawal" has arguably been quite successful, the crust-of-the-biscuit will be the cost per bbl to refill the SPR as well the benefits of lowering inflation (my followers know I have long said that the primary cause of inflation in the U.S. has historically been directly linked to the price of oil).

How "Strategic" Is The SPR?

As I reported in a recent Seeking Alpha article, today we live in a new "Era of Energy Abundance." That is, the global energy supply today is much different (and abundant ...) than it was when OPEC dominated the global oil market back in the late 1970s and early 1980s.

That's because that was before the Canadian oil sands came online. For example, in December the U.S. imported more than 4 million boe/d from Canada. And there are 10s of billions of barrels of proven tar sands reserves ... so much, in fact, that some scientists say if we burn them all we'll burn up the planet in the process.

Meantime, the major change from the last 1970s was the technological disruption of the global oil and gas market by the combination of horizontal drilling and fracking. That has led to - once again - 10s of billions of bbls of proven U.S. shale reserves (at $40/bbl WTI, let alone $70/bbl ...) that can be very economically drilled with a near 100% success rate and brought online to existing pipelines within a matter of a couple of months. That technology disruption led to the U.S. being the No. 1 petroleum producer on the planet.

That being the case, I would argue that the U.S. already has a "strategic petroleum reserve," and it's the massive shale oil and gas reserves that live in the shale rocks instead of in the salt caverns of the SPR. Does it take a bit longer to produce? Of course. But shale O&G is still "short cycle" despite what some of the energy company CEO's are saying these days. Ironically, note these same CEOs marketed shale as "short cycle" assets for over a decade during the "drill baby drill" days. Apparently, some of them have changed their mind since Biden took office and said it was impossible to respond to Russia's actions with higher production. The ramp-up in natural gas supply for LNG exports to the EU last year pretty much disproved that narrative in spades.

Meantime, the EIA's Weekly Status Report issued Wednesday morning reported that U.S. commercial inventories (excluding the SPR) stood at 481.2 million bbls - an increase of 1.1 million bbls from the previous week and a level that is ~8% above the five-year average level for this time of year. That certainly doesn't look like a "dooms-day" scenario to me.

Meantime, Chevron (CVX) is still on target to raise Permian production to 1 million boe/d by 2025 and then the company plans to hold it above 1 million boe/d until at least 2040. Exxon (XOM) continues to develop the massive Guyana elephant field with an eventual production target of over 1 million boe/d. Exxon also is increasing its Permian production at a rapid pace.

The fact is, we live in an "Age of Energy Abundance," and if you don't believe me, please read previously referenced article as I go into much more depth on the subject.

President Biden - Progressive or Simply Pragmatic?

Another false narrative is that President Biden hates oil and gas. Yet history shows that simply is not the case. I say that because:

- U.S. oil production grew faster under Obama/Biden than it did under either Bush administration or Trump.

- It was the Obama/Biden administration that lifted the decades old crude-oil export ban.

- It was the Obama/Biden administration that licensed all the U.S. LNG export terminals now in operation that enabled short-cycle U.S. gas producers to supply the EU with badly needed natural gas last year.

As a result, and in the face of the false narratives being spun by self-serving politicians and some oil company CEOs:

- The U.S. is the No. 1 petroleum producer on the planet.

- The U.S. took over as the No. 1 LNG exporter on the planet last year.

These same politicians like to point out that the U.S. still imports millions of bbls of foreign crude every day, which is true. What they don't understand and don't tell you is that this oil is imported simply because U.S. refiners spent 100s of millions of dollars decades ago to configure their refineries to run a slate of heavy/sour crude from sources like the Canadian tar sands, Venezuela, and Saudi Arabia. That was before the technological disruption of Hz-drilling and fracking and when those countries were thought to be the primary sources of oil for decades to come. Obviously these refineries are not optimized to run light-sweet shale oil - which is among the highest quality oil in the world. Domestic production of light-sweet shale oil long ago exceeded domestic refining capacity and, as a result, the U.S. is a growing crude oil exporter. This is what the politicians don't tell you in their 10-second sound bites when they want to convince you that the U.S. is somehow in deep peril because it is not energy independent. Nothing could be further from the truth.

More proof that Biden has a pragmatic attitude with respect to energy policy is his recent approval of ConocoPhillips' (COP) Willow Project in Alaska. I wrote about this subject in May 2021 and explained to investors that this project was much more than simply about another oil field - it was about national security and keeping throughput on the Trans-Alaskan Pipeline high-enough to keep from having to shut it down (see Why Biden Approved COP's Willow Project: It's All About Securing the TAPS). Note that COP stock is +80% since that BUY rated article. This was simply more of the same from Biden: Pragmatic energy policy that takes into account national security and economics.

Now the progressives went completely nuts over approval of the Willow project. But they too simply don't understand the challenge and magnitude of the transition to renewals and EVs and the time it will take. Nor do they understand how many shale wells would have to be drilled to equal the 160,000 bpd production target that COP has for Willow. That would be a lot of shale wells (and much greater emissions). The point is, that oil is going to be consumed whether the U.S. produces it or not, and the Willow project is arguably one of the lowest emissions sources on the planet - certainly much less so as compared to the tar sands from Canada or shale oil from the Permian.

Summary and Conclusion

Simply because Biden understands that global warming is an existential threat to planet - and wants to accelerate the transition to renewables and EVs - does not mean he is incapable of making hard, pragmatic energy policy decisions. Biden's record certainly shows that he's a very pragmatic energy policymaker, and the release 180 million bbls of crude oil from the SPR is simply another example of his pragmatism leadership. And, so far, Biden's strategy has worked out to the great benefit of the American consumer as well as providing a nice profit for the U.S. government.

That said, we are in the shoulder season and there were some financial "hijinx" behind the recent sell-off in oil. Indeed, Jeff Currie of Goldman Sachs, who has been one of the absolute bullish analysts on oil, explained that on CNBC this morning (see this video). At least some of it. However, note Currie spent some time making a bullish comparison between today and the 2008 spike to $150/bbl. Despite some similarities with respect to banking drama, the big difference between now and then, of course, is that today we have U.S. Shale and Currie neglected to mention that the previous oil spike was arguably caused by Bush's decision to invade Iraq. That took millions of bbls of oil off the global market at the exact same time that China was ramping up imports. That being the case, I don't buy into Jeff's narrative.

However, I do believe that - barring a hard landing in the U.S. economy - we'll likely see another strong driving season and a continued ramp-up in China oil imports. Assuming that China's President Xi doesn't decide to chop off his economy (and the global economy ...) at the knees by giving Russia military assistance, I would expect WTI in the second half of the year to be closer to $85/bbl as compared to today's $70/bbl. Regardless, note that tier-1 shale producers like COP, CVX, and XOM are break-even in the Permian at under $40/bbl (likely closer to $35). That being the case, these companies are going to turn in another year of massive profits and free cash flow generation regardless of which scenario actually happens.

"strategy" - Google News

March 23, 2023 at 05:19AM

https://ift.tt/P5i7jgF

Analysis: The Strategic Petroleum Reserve - Seeking Alpha

"strategy" - Google News

https://ift.tt/nr5IUo7

https://ift.tt/jJYrWRF

Bagikan Berita Ini

0 Response to "Analysis: The Strategic Petroleum Reserve - Seeking Alpha"

Post a Comment