Scharfsinn86/iStock via Getty Images

I cautioned investors from adding to Plug Power Inc. (NASDAQ:PLUG) stock in early August, as I highlighted that its holders could find themselves getting "rolled over." As such, I urged PLUG dip buyers who added at its May lows to take profit, given the significant upside from those levels.

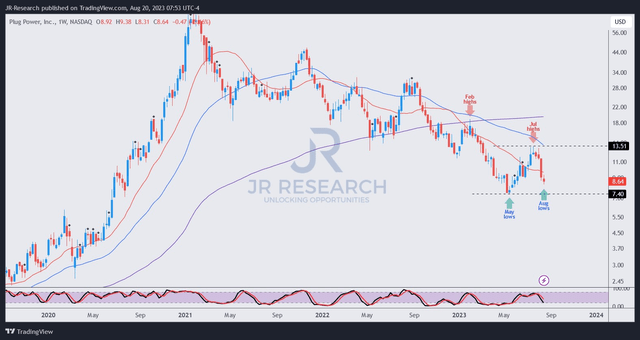

Accordingly, PLUG has significantly underperformed the S&P 500 (SPX) (SPY) by a mile since my caution. Moreover, most of the gains from its May lows have been dissipated, as PLUG topped out resoundingly in mid-July. No, I don't have clairvoyant powers, and it isn't linked to my crystal ball gazing. However, in July, red flags were already brewing in PLUG's price action at a critical resistance zone. Therefore, astute dip buyers likely used the zone to distribute and sell quietly, allowing them to get out with a nice profit without triggering a steep collapse.

However, the inevitable arrived eventually, as Plug Power delivered yet another underwhelming report, continuing its "overpromising and underdelivering trend." Notwithstanding the better-than-expected topline growth, it posted a worse-than-anticipated bottom-line miss. The negative reaction post-earnings concluded that market operators weren't amused with management's commentary and assurances, as Plug Power delayed the commencement of its green hydrogen facilities (excluding Georgia's facility) by about six months.

I reminded PLUG holders that given its unprofitability and weak execution, it's challenging to envisage high conviction in dip buyers, given PLUG's unjustified surge from its May lows. Plug Power's commentary at its recent earnings call highlighted its $2B in cash and investments. It also reminded investors that it remains well-placed to secure non-dilutive financing to buttress its CapEx-heavy build-out as it attempts to scale toward profitability.

The company also remains optimistic about securing a $1B project financing facility from the Department of Energy, which was reportedly in the "final stages of due diligence." Based on the updated consensus estimates, Plug Power is expected to burn through nearly $2B in negative free cash flow or FCF from H2'23 to the end of FY25. As such, the company must scale its green hydrogen projects expeditiously for margin accretion.

However, investors must also be wary about putting too much emphasis on management's optimism, as PLUG's price action has indicated that market sentiments haven't been aligned.

Industry leader NextEra Energy (NEE) highlighted at its recent earnings call that the scalability of hydrogen projects is still in its infancy. The renewable energy leader believes green hydrogen has substantial potential to underpin the company's growth. However, it also cautioned that "[green] hydrogen projects have a longer development cycle." As such, investors must consider the possibility that green's hydrogen "impact on industry and emissions reduction will likely be realized over the latter part of this decade."

Therefore, I believe pure-play unprofitable green hydrogen players like Plug Power remain a "show-me" story for investors even as it aims to achieve highly ambitious medium-term goals through FY26.

PLUG price chart (weekly) (TradingView)

With my Sell (bearish/market underperform) thesis playing out as PLUG fell toward its early June lows, I consider most of the near-term downside has been fulfilled. As such, I expect PLUG to potentially consolidate as market operators assess whether PLUG's May bottom could be breached.

If PLUG holds its May lows, the recent steep selloff could mark a "final" capitulation move to take out weak dip buyers before staging a more sustained recovery.

However, it's still too early to assess whether such an opportunity could play out. As such, investors looking to buy the recent selloff requires high confidence in PLUG's underlying growth drivers. While I wouldn't rule out a speculative set-up moving forward, I prefer to see how the expected consolidation could pan out before revising my rating further.

With that in mind, I move back to the sidelines on PLUG.

Rating: Upgraded to Hold. Please note that a Hold rating is equivalent to a Neutral or Market Perform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn't? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

"strategy" - Google News

August 22, 2023 at 01:00AM

https://ift.tt/A7H8dGe

Plug Power: Why Relying On Hope Isn't An Investment Strategy (NASDAQ:PLUG) - Seeking Alpha

"strategy" - Google News

https://ift.tt/4u1QsRy

https://ift.tt/7Y1bjeo

Bagikan Berita Ini

0 Response to "Plug Power: Why Relying On Hope Isn't An Investment Strategy (NASDAQ:PLUG) - Seeking Alpha"

Post a Comment