isayildiz/E+ via Getty Images

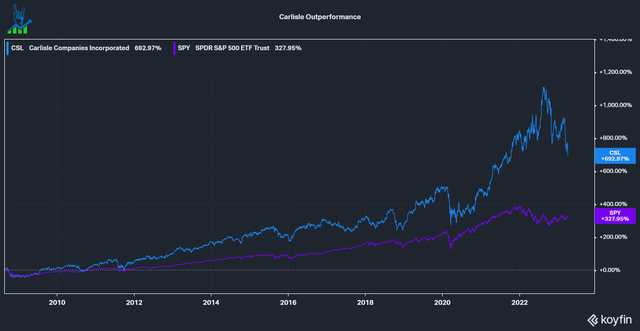

Carlisle Companies (NYSE:CSL) is a diversified holding company that operates businesses across various industries. Founded in 1917, the company has a long history of innovation and success. Historically, the company operated in very different segments but has started focusing on core markets with attractive economics in recent years. Carlisle has a reputation for quality and excellence, and its commitment to customer satisfaction is evident in its operations. With a focus on growth and expansion, Carlisle continues to be a leader in its field, driving innovation and creating value for its customers and of course, shareholders as well: Over the last decade, the company returned 692%, a 15% CAGR, even after the 34% drawdown from the high in August 2022. Let's see if Carlisle can continue winning.

Carlisle outperformance (Koyfin)

The building products industry

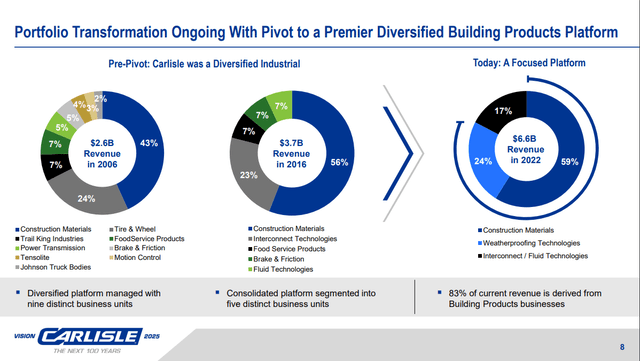

Over the last 16 years, Carlisle transformed from a diversified industrial conglomerate to a focused platform in the building products industry. The restructuring was part of Vision 2025, which will be covered in the next segment. By divesting non-core and underperforming assets, Carlisle focused on just three segments, with 83% of those revenues coming from Building products focusing on Roofing solutions and Weatherproofing Technologies. The company estimates it doubled its total addressable market ("TAM") from $15 billion in 2012 to $30 billion in 2022. The roofing market is expected to grow at a 3% CAGR, so relatively modest growth. If we take the $30 billion TAM and compare it with the $6.6 billion in FY22 revenues, we can estimate an average market share of 22%.

Portfolio Transformation (Carlisle Investor Presentation)

Carlisle Operating System as an advantage

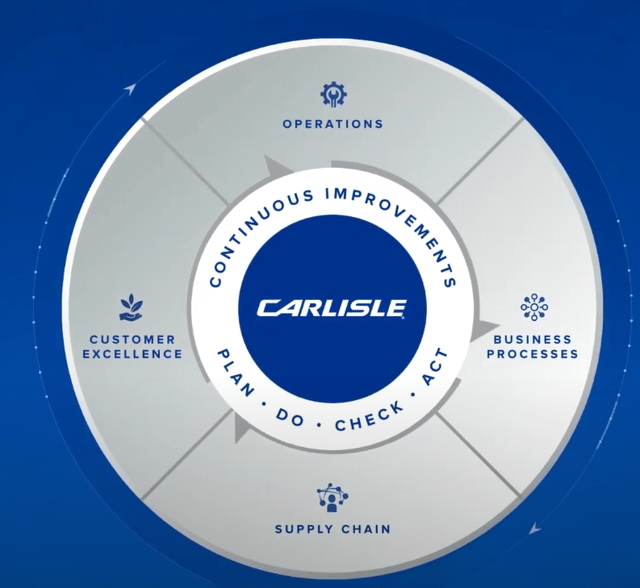

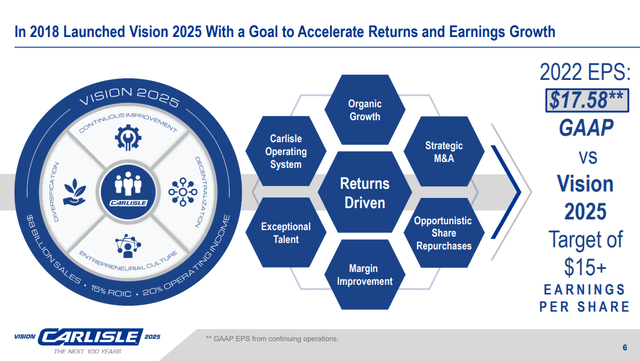

In 2018 the company launched its Vision 2025 program, where it set goals to reach $8 billion in sales with 15% ROIC and a 20% operating margin. To achieve this, the company wanted to leverage its Carlisle Operating System ("COS"); the system has four key components:

- (Decentralized) Operations.

- Businesses Processes.

- Customer Excellence.

- Supply Chain.

With Continuous Improvements at the heart of the system as well as nurturing an entrepreneurial culture, the COS is Carlisle's competitive advantage.

Carlisle Operating System (Carlisle youtube channel)

Four years in, the Vision 25 goal of $15 EPS was already beaten with $17.58 in 2022 and we saw earlier that the total return rewarded the company for this performance.

Vision 25 (Carlisle Investor Presentation)

Carlisle grew revenues by 6% a year organically and added another 2% through M&A (minus divestitures) while growing operating (measured in adjusted EBITDA) margin from 15% to 24% and generating ROIC of over 20% as of late. The company continues to allocate capital to its high return Building products businesses with over 30% ROIC. The COS reminds me a lot of the Danaher (DHR) Business System, a core holding of mine, which is also focused on making Kaizen (Continuous Improvement) a way of life for the company. I love businesses that lay such a focus on Kaizen and Carlisle fits the bill nicely.

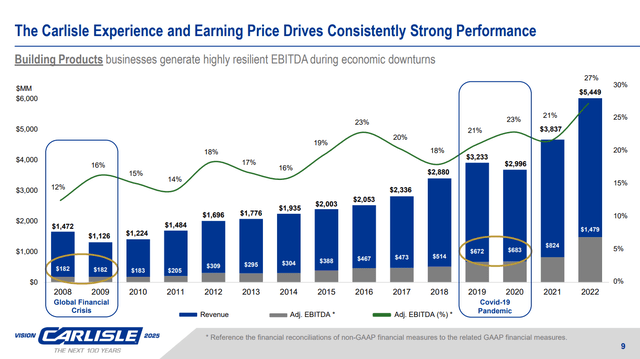

History of recession-resilient results

With a possible recession looming over the market and especially fears in construction, we can look to Carlisle's track record of performing during recessions. If we take the GFC and Covid as examples, we can see that revenues did fall in both cases between 7-24%, but operating profits stayed flat. The company can pivot to cost savings and hike its margin (12% to 16% during the GFC and 21% to 23% during Covid). Given the current macro fears, this is reassuring, but we should remember that the margin expanded significantly in 2022 from 21% to 27%. With a gross margin of 35%, it is hard to see significant further improvements shortly.

A history of recession-proof earnings (Carlisle Investor Presentation)

Carlisle is a buy

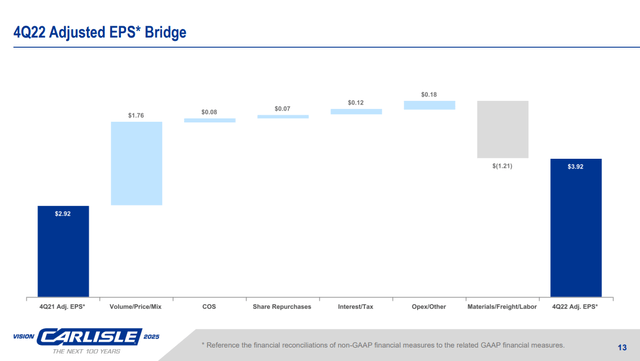

Valuing CSL stock is difficult because the company saw a surge in revenue and cash flows in 2022, where revenue grew from $4.8 to $6.5 billion and operating cash flows from $426 million to $1 billion. The company did an excellent job of passing on inflationary costs to its customers. Overall the company expects to keep this revenue and to achieve single-digit revenue growth in 2023 and slight EPS growth.

Q4 22 EPS Bridge (Carlisle Q4 22 earnings )

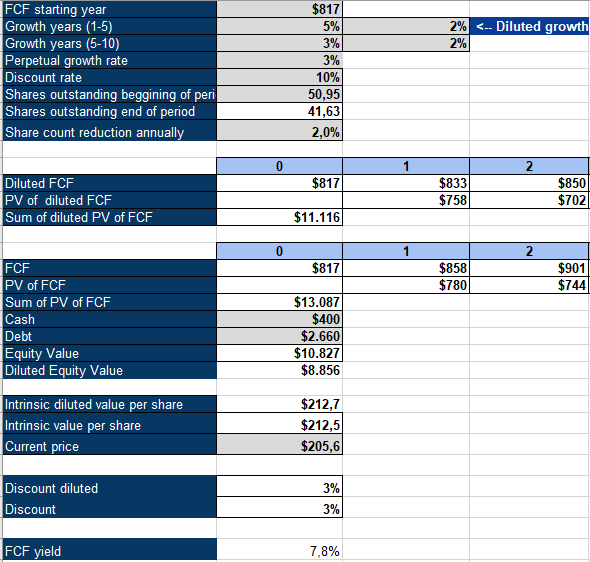

Let's value the company with an inverse DCF model using a 10% discount rate and a 3% perpetual growth rate. I used the trailing Free cash flow of $817 million; although the company saw a surge, they expect to keep the price increases and see modest growth in EPS. Historically, the company has a high net income to free cash flow conversion, averaging over 100%. Recently the company saw a surge in inventory coming from the increased prices of the new inventory coming in. There could be a risk of inventory write-downs, but I do not see that as material. Historically we saw 2% annual buybacks, so I used that in the model. Using these assumptions, we get to a 2% expected growth rate. For the next three years, analysts expect 2% earnings growth in FY23, followed by ~8% in FY 24 and 25. Carlisle looks like a steal, especially considering the high quality of the business. I rate Carlisle a buy, not a strong buy because there is the risk of potentially over earning in the last year and normalization in profits. The company and analysts don't expect it to happen, but I'd be cautious still.

Carlisle Inverse DCF (Authors Model)

"strategy" - Google News

April 08, 2023 at 09:00PM

https://ift.tt/JuXlZeV

Carlisle Stock: Focused Strategy, Impressive Performance, Resilience (CSL) - Seeking Alpha

"strategy" - Google News

https://ift.tt/JxP1MmX

https://ift.tt/6dDSCpA

Bagikan Berita Ini

0 Response to "Carlisle Stock: Focused Strategy, Impressive Performance, Resilience (CSL) - Seeking Alpha"

Post a Comment