skynesher/E+ via Getty Images

Investment thesis

Our current investment thesis is:

- LAD operates an attractive business model, with a rapid expansion and modernization of its services to remain at the forefront of consumers' key value factors, such as convenience.

- Management considers M&A a cornerstone of its strategy, seeking to exploit the fragmented nature of its industry to gain scale and market share relative to its peers.

- We suspect growth will continue, although margins will likely incrementally fall as supply within the automotive industry normalizes.

- At a discount to its historical average trading multiple, a NTM FCF yield of 14.5%, and a discount to its peer group, we consider the stock a buy.

Company description

Lithia Motors, Inc. (NYSE:LAD) is a leading automotive retailer in the United States, operating through a network of dealerships offering new and used vehicles, vehicle maintenance, repair services, and automotive financing. The company serves a wide customer base across various states.

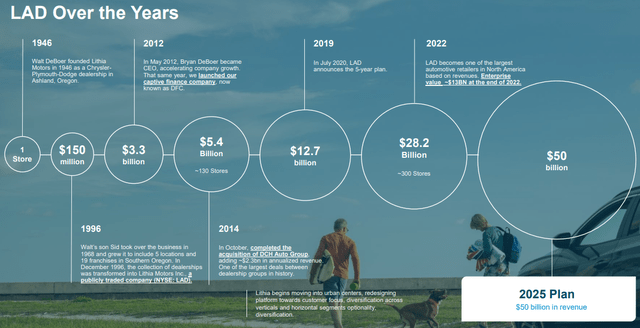

Lithia Motors Timeline (Lithia Motors)

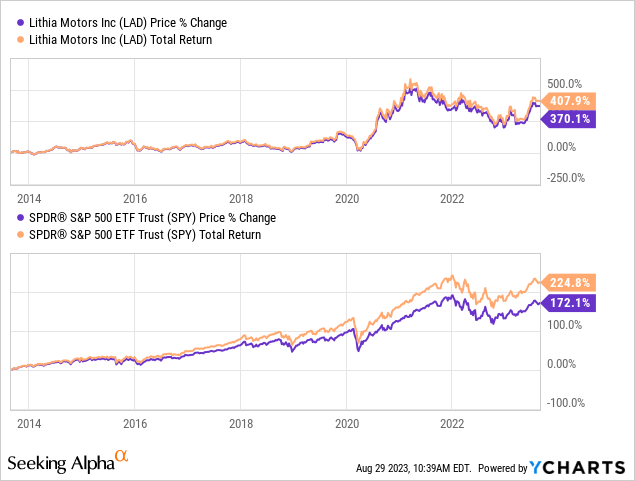

Share price

LAD's share price performance has been impressive, particularly in recent years, contributing to a significant outperformance relative to the market. This has been driven by an acceleration in financial performance.

Financial analysis

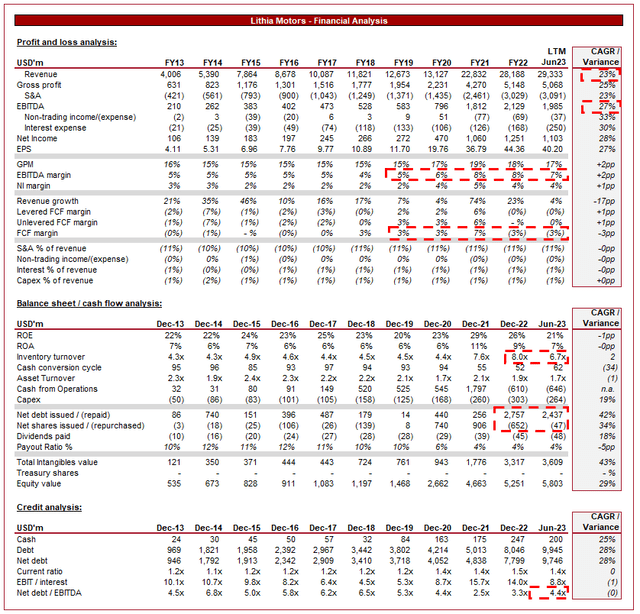

Lithia Financials (Capital IQ)

Presented above are LAD's financial results.

Revenue & Commercial Factors

LAD's revenue has grown at a CAGR of 23% during the last decade, with consistently strong growth YoY. Although organic growth has been healthy, this trajectory has been materially supported by M&A, allowing the business to materially overperform.

Business Model

LAD operates a network of dealerships that represent a variety of automotive brands, including both new and used vehicles. The company sells new vehicles from various manufacturers and offers a selection of high-quality used vehicles, providing customers with diverse options to choose from.

Consumers within this industry are extremely price conscious, as the product sold is extremely similar between dealers (identical in the New segment). Following price, consumers care about choice, additional and related services provided, as well as customer experience.

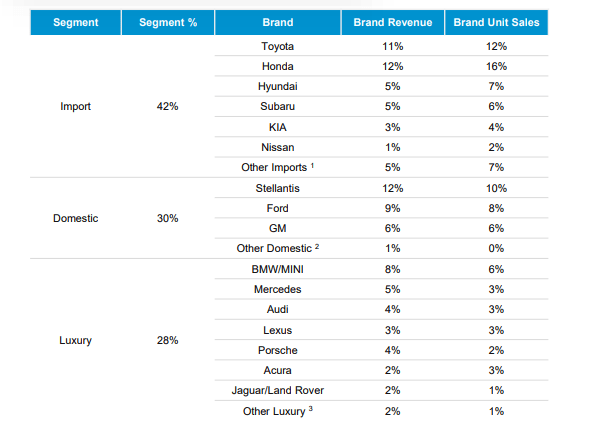

As the following illustrates, LAD sells a vast range of New vehicle brands, making it a great option for a significant amount of the US public (and to a lesser extent in the UK and Canada). The healthy mix between the three segments is extremely beneficial for diversification purposes, reducing exposure to specific market trends.

Brands (Lithia Motors)

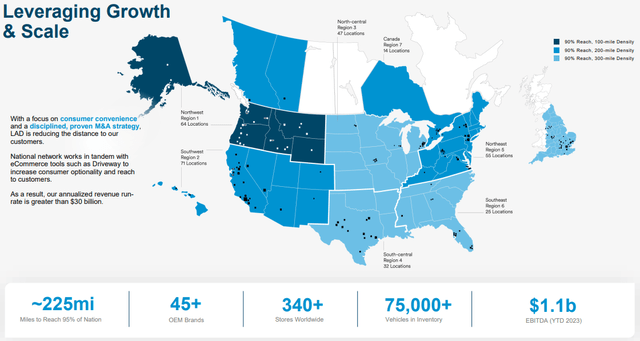

Further, LAD has an extensive network of dealerships that spans multiple states, providing broad reach and accessibility to individuals. The network operates in a beneficial way for customers, allowing consumers to easily see stock across nearby dealerships and have vehicles delivered where appropriate. M&A has allowed the business to strategically expand its reach, with a key focus on proximity to major population hotspots.

Geography (Lithia Motors)

In conjunction with New and Old vehicle retailing, Lithia provides maintenance, repair, and other automotive services through its service centers, generating recurring revenue from service appointments. Further, the company offers financing and leasing options to customers purchasing vehicles, enhancing the overall buying experience. Both services are highly valued by consumers. From LAD's perspective, this is lucrative due to the recurring nature of income, as well as the higher margins associated with these services. Therefore, they a highly accretive to the wider business.

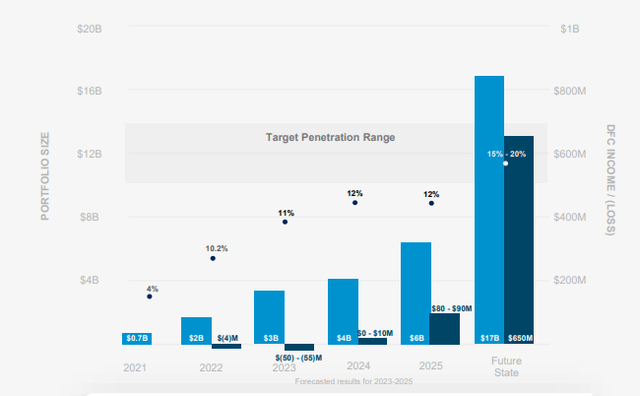

As the following illustrates, the focus on growing financing activity has been successful. with a long-term objective to increase the penetration rate further.

Financing (Lithia Motors)

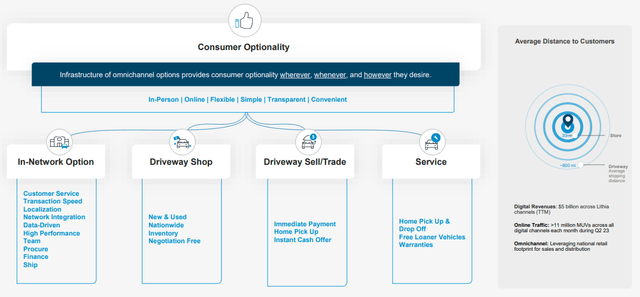

The company has developed a strong online platform that allows customers to browse inventory, schedule service appointments, and explore financing options, enhancing convenience for consumers. The objective has been to make the purchase/financing of a vehicle as easy as purchasing any other product online. This development has come as a response to the rise of competitors such as Carvana (CVNA).

Our view is that LAD has quality infrastructure in place to ensure a market-leading omni-channel offering, built on the desire to provide convenience. Any support a consumer could require is available at a close proximity.

Omni-channel approach (Lithia Motors)

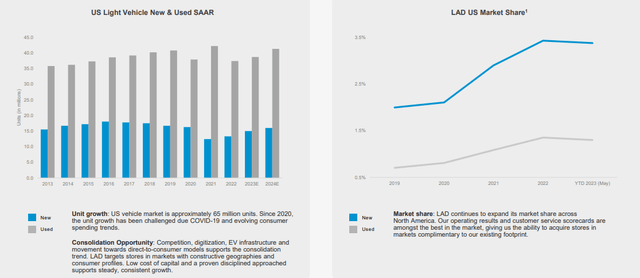

The factors listed above are all highly valued by consumers, with the success of LAD's ability to execute illustrated by its strong market share across both the New and Used segments, with consistent gains over the last several years.

The industry was materially disrupted by the pandemic period, with LAD taking advantage of this to overperform its peers to gain market share.

Market share (Lithia Motors)

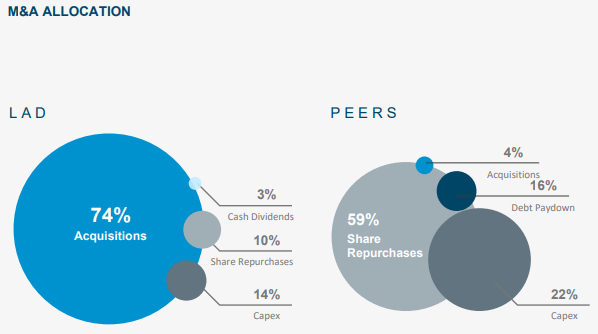

A core component of Management's strategy is M&A. LAD is a major consolidator within the automotive industry. This is possible due to the fragmented nature of the US dealership network, allowing LAD to aggressively expand by utilizing its existing scale.

As the following illustrates, its capital allocation strategy is a major departure from the average of its peers. This has been highly successful as its share price performance reflects, with future scope for Share buybacks as FCFs are incrementally enhanced.

Capital allocation (Lithia Motors)

Automotive Industry

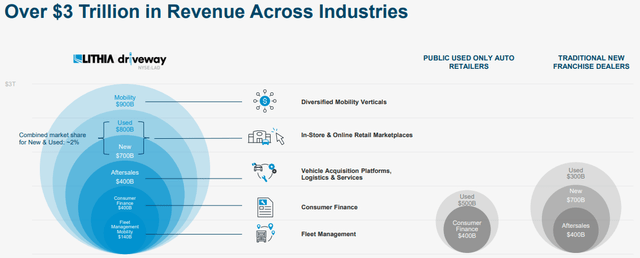

Industry (Lithia Motors)

As touched on previously, the automotive industry is highly fragmented, with significant market share still "on the table" for LAD to acquire in the coming years. Importantly, the company has an impressive track record and so its playbook works. Investors should not fear the future success of this. Importantly,

Management is not just focused on increasing scale but ensuring a strategic fit with its long-term vision (such as supporting online retailing, financing, and services).

The automotive industry has experienced consistent consumer demand for new and used vehicles, although experienced a material shock post-pandemic, following the shortage of supply (mainly due to semiconductors). This contributed to a rapid acceleration of revenue as prices rose to balance supply/demand. This has begun to soften, contributing to a slowdown in revenue growth and a decline in margins.

The average of the US fleet has consistently increased during the last decade, likely reflecting tightening finances and improved longevity of vehicles thanks to technological development. This should support the health of the Used vehicle market, alongside the demand for services.

Finally, building strong relationships with customers through quality service and a diverse product range can lead to repeat business and word-of-mouth referrals. The LAD business model has been positioned perfectly to provide the best possible service to customers, which based on reviews, suggests is successful.

Economic & External Consideration

Current economic conditions are contributing to a softening in the demand for vehicles, with high inflation and elevated rates reducing large ticket purchases to protect finances. We suspect this will continue in the coming quarters, as a decline in rates looks extremely unlikely in the near term.

The takeaways from LAD's most recent quarter are:

- Revenue growth of 12%, demonstrating strong operational resilience in the face of a clear slowdown.

- New and Used unit growth was +22% and (1)%, suggesting the underlying weakness is beginning to take effect. The strength in New sales is likely in part due to the availability of stock improving.

- Service, body, and parts grew 18%. This is an extremely strong performance and illustrates its attractiveness alongside dealership activities.

Overall, LAD's business model has shown its strength during tough economic conditions but it is difficult not to suggest a softening of financial performance is ahead.

Margins

LAD's margins have trended up in the last decade, primarily due to the structural changes in the automotive industry. This said, we do believe the business has the capacity to normalize above its pre-pandemic level, as scale and an expansion of high-margin services drives accretion.

Balance sheet & Cash Flows

LAD's inventory turnover has noticeably declined in the L6M, contributing to a decline in FCF to negative levels. This is broadly due to increased Finance Receivable and a build-up of vehicle inventory. At a normalized level, we believe the company can generate an FCF margin of c.3%.

LAD's debt balance has grown consistently due to the financing of the acquisitions, reaching an ND/EBITDA level of 4.4x. With interest payments at 1% of revenue and an interest coverage of 8.8x, we are not overly concerned about this running away.

Outlook

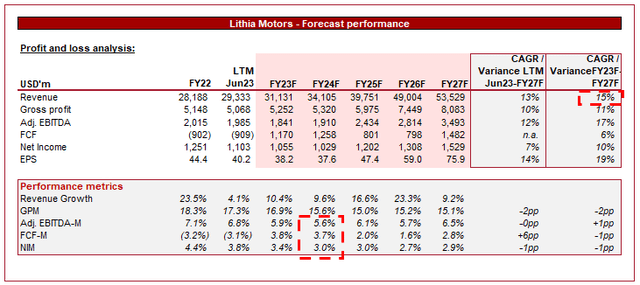

Outlook (Capital IQ)

Presented above is Wall Street's consensus view on the coming 5 years.

Analysts are forecasting a continuation of its low double-digit growth trajectory, alongside a softening of margins. This looks to be a reasonable assessment as the company's strong business model in conjunction with its proven track record of M&A should ensure an extension of its current trajectory. Further, the softening of the automotive industry likely means a decline in margins is inevitable.

Industry analysis

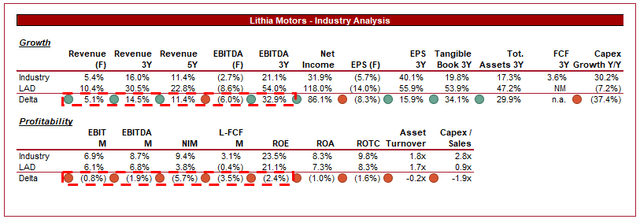

Automotive Retail Stocks (Seeking Alpha)

Presented above is a comparison of LAD's growth and profitability to the average of its industry, as defined by Seeking Alpha (19 companies).

LAD performs relatively well in our view. The company has outperformed the industry across the key growth metrics, both for profitability and margins. This is a reflection of the company's superior business model and aggressive investment in growth.

LAD is slightly lacking in margins but this is more so due to the peers included within the industry, as parts-only businesses are more profitable on average than dealers. Given the small delta, we consider this a strong performance.

Valuation

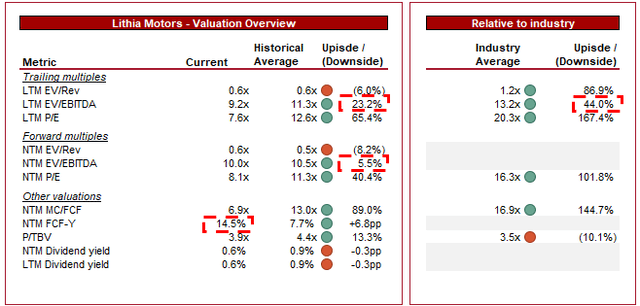

Valuation (Capital IQ)

LAD is currently trading at 9x LTM EBITDA and 10x NTM EBITDA. This is a discount to its historical average.

Purely on its current performance, a premium on its historical average would be warranted in our view, given the improvement in scale and margin improvement. However, it is clear that margin deterioration will continue, which could mean a reversion to its historical levels. With this in mind, we would conservatively suggest parity with its historical level is fair. Based on this, there is currently a 6-23% upside at an EBITDA level.

Further, we believe LAD warrants a small discount to its peer group average, purely due to the margin deficit and increased cyclicality relative to the parts-only sub-cohort. Again, this implies a healthy double-digit upside at LAD's current valuation.

Finally, as a confirmatory point, LAD is currently trading at an above-average NTM FCF yield (14.5%). Even if this will be utilized for deleveraging in the near term, we still believe this is attractive.

Key risks with our thesis

The risks to our current thesis are:

- Margin / FCF risk. Management must seek to stem the margin decline while improving FCF, a difficult task during current economic conditions. A continuation of this will make it far more difficult to normalize at a healthy level once market conditions improve given the level of competition in the industry.

Final thoughts

LAD is a fantastically run business. The business model is strong, with continued incremental improvements centered around making its dealerships, and broader offerings, as attractive as possible to consumers. When considered in conjunction with its rapidly increasing scale, LAD is perfectly positioned to be the premier investment opportunity in this industry.

We expect its current trajectory to continue as M&A is utilized to enhance the business, although margin erosion appears inevitable as the market softens further.

At a discount to its historical average and peer group, and a NTM FCF yield of 14.5%, we believe LAD is an attractive buy.

"strategy" - Google News

September 05, 2023 at 01:21PM

https://ift.tt/F8Bf3tC

Lithia Motors: Unveiling Its Strategy For Dominating The Automotive Industry (NYSE:LAD) - Seeking Alpha

"strategy" - Google News

https://ift.tt/CxKzL64

https://ift.tt/G5NxnQo

Bagikan Berita Ini

0 Response to "Lithia Motors: Unveiling Its Strategy For Dominating The Automotive Industry (NYSE:LAD) - Seeking Alpha"

Post a Comment