Paresh Gada(Left) and Hasmukh Gada (Right) did not know even the basics of stock trading but after learning the ropes they are now making good money.

For many traders, the market is like a temple. Similar to how each devotee has different reasons to come to a temple, each trader has a different driving force that brings him to the market. For Hasmukh Gada (@iamhasu) and Paresh Gada (@pareshgada) – Mumbai-based brother duo – it was boredom handling their family business.

About four years ago, these two businessmen didn't even knew the basics of stock trading but after learning the ropes they are now generating good supplementary income for themselves. However, they deny that becoming experts and believe that their learning phase is still ongoing.

Gada brothers prefer option selling using various strategies with a target to generate at least 2 percent profit each month. They said they have generated 36 percent returns from their trade in the first nine months of FY23.

Investing to trading

Despite starting their trading journey in 2019, Gada brothers are not new to the stock market. Before venturing into trading they have been long-term investors in the market – which they still continue to be – and have seen a few market cycles.

Gada brothers – both college dropouts and hailing from a Gujarati family – chose to handle their family retailing business at a young age. Once they established themselves in the business, they also started regularly investing whatever income they could save in the stock market from 2005 onwards – largely in quality companies.

Soon came the 2008 crash, which cut down their portfolio value by half but also taught them a lot. They employed those learnings over a decade later during the March 2020 crash to accumulate quality stocks at a discount. By then they had already started trading. Thus they also used their stock holdings to get margins for trading by pledging them.

Gadas does not have any particular strategy that they are fans of but short Strangle is one they find themselves using more often. This non-directional strategy involves selling call and put options simultaneously, usually out of the money (OTM) strikes. Strangle is known as one of the simplest strategies that one can deploy in the market.

Hasmukh says that despite being relatively inexperienced traders, they have seen major drawdowns in their trading just once when Russia attacked Ukraine in February last year and they had taken a naked position and suffered a loss. Since then, they usually put a hedge.

Trade Setup

Hasmukh, explaining their strategy, said that it involved selling OTM call and puts – usually equidistant from the at the money (ATM) strike – and carrying that position until it yields minimum 2 percent return. Below are a few basic steps that they use to set up their trades. Before that, a disclaimer that Gada brothers are not Sebi registered financial advisors, hence, this trade should not be construed as financial advice.

Step 1: Load up near-month expiry option chain at the start of the series. Take a look at India VIX index – an indicator that measures market volatility. Higher the VIX, more are the chances that the range of Nifty’s movement will be larger.

Step 2: If India VIX is high, say above 15-16, move 500 points each side and sell equal lots of call and puts. For example, if the Nifty is close to 18,000, then sell 18,500 call and 17,500 put. On the other hand, if VIX is low, say around 12-13, you can move closer to the ATM to collect more premium. For example, you can sell 18,350 call and 17,650 put.

Step 3: If any one leg – whether put or call – shows loss, then rather than booking losses try to adjust losses by selling weekly options. Alternatively, sometimes it is also better to adjust monthly options.

Step 4: Once you have generated 2 percent profit, put a stop loss and keep trailing it. Don’t let that 2 percent profit go at any cost.

Step 5: If you have taken a big position, make sure you hedge your position. For that you can buy call or put options very deep in the money. This will cushion your losses if your trades go bad.

Risk management

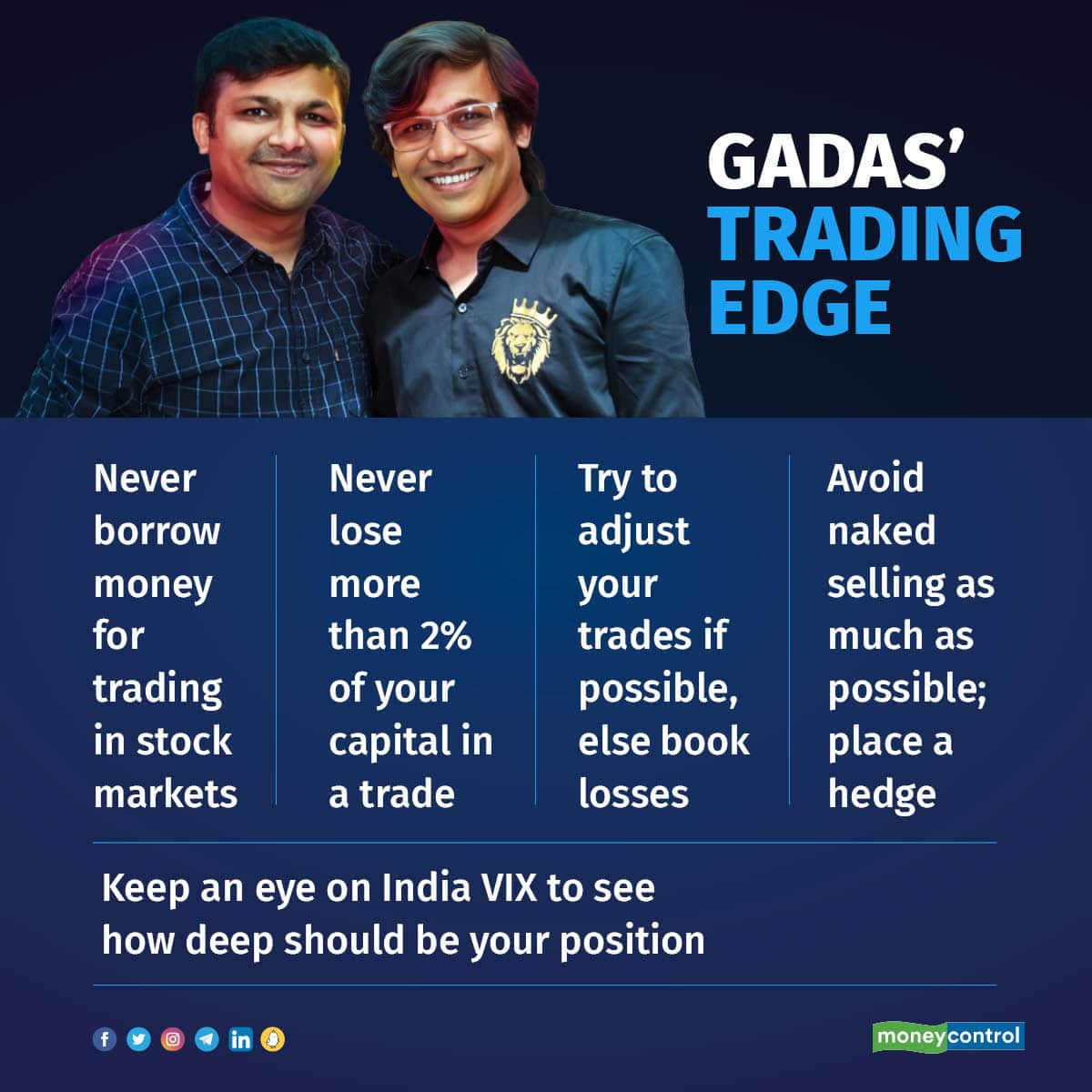

Having singed their hands just last year, Gada brothers have become more cognisant of risks in trading. Now they try not to take a large naked position and put a hedge.

Hasmukh also said they keep maximum loss from a trade to 2 percent of their capital. If the overall loss of their position reaches this mark, they always square off rather than adjust further.

They also advise budding traders to not borrow money from friends or family to trade in the market even if you have tasted success. “Always trade with your own money,” Hasmukh said.

They also advised not to use more than a quarter of the entire capital you have for trading. Keep 75 percent for other purposes or invest in good quality companies or mutual funds.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions."strategy" - Google News

January 14, 2023 at 02:04PM

https://ift.tt/40zbOK9

Trader’s Edge: Two brothers are making a killing in the market with a simple option strategy - Moneycontrol

"strategy" - Google News

https://ift.tt/W5jdD2x

https://ift.tt/UrIo4si

Bagikan Berita Ini

0 Response to "Trader’s Edge: Two brothers are making a killing in the market with a simple option strategy - Moneycontrol"

Post a Comment