Can you use call options as a substitute for long stock? If you’re a qualified account owner, yes. Learn about buying stocks versus buying calls with the stock replacement strategy.

Photo by Getty Images

Key Takeaways

- A long call option can be used as an alternative to the outright purchase of stock, but there are trade-offs and risks

- Long options strategies offer defined risk and potentially efficient use of capital

- Some advanced traders use the bullish diagonal spread as an adjunct to the stock replacement strategy

Some retail investors have a simple investment strategy: Buy stock in a good company with attractive earnings, growth, or dividend yield potential.

Does this describe your strategy? If so, you might hold stocks in an account and hope they produce positive returns.

You might be avoiding stocks with high nominal prices because it only takes a few shares to eat up large percentages of a portfolio. Plus, you want to limit your exposure in one stock to spread out the risk—the old “eggs-in-several-baskets” approach.

And options? You might not have considered them because you think they’re only for the highly advanced trader set.

Let’s see if we can change that thinking through education and discussion.

What if we told you that even a small account could invest in shares of Apple (AAPL), Microsoft (MSFT), Netflix (NFLX), or any other high-priced stock, with essentially the same amount of upside potential—and potentially lower risk of capital outlay—versus simply buying the stock? Some options strategies are designed to make that happen.

Intrigued? Excited? You should be. Because this simple strategy can potentially allow smaller accounts to participate in higher-priced stocks (for a limited time) and larger accounts to increase volume with decreased capital outlay and defined risk.

Here’s the basic overview of the differences between buying a call option and outright ownership of a stock.

The Rationale … and the Setup

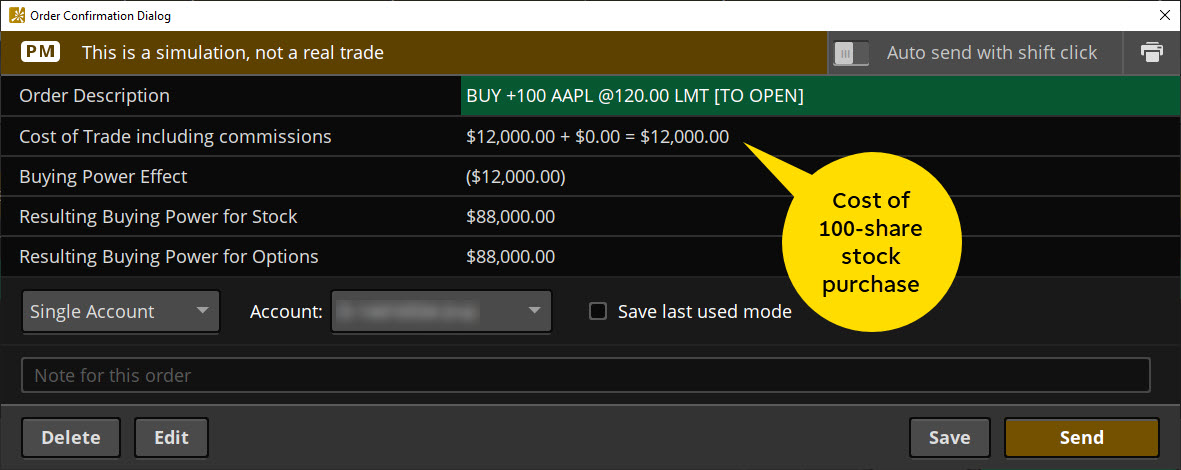

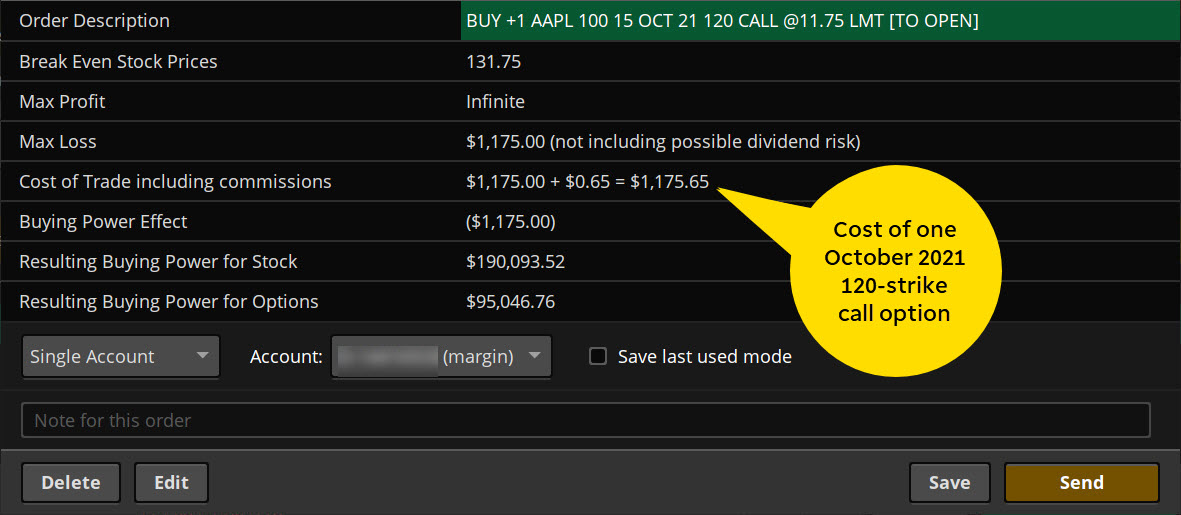

At $120 per share (as of March 2021), 100 shares of AAPL cost about $12,000. But a bullish strategy on AAPL can potentially be executed for a fraction of that cost and with significantly less downside risk. Instead of simply buying AAPL stock, a qualified investor could purchase a long-dated call option.

For example, the call option in the order ticket below—with a strike price of 120 and an expiration date seven months away—is offered at $11.75. Standard equity options contracts are deliverable into 100 shares, so the total cost of this 100-share exposure is $1,175 (plus transaction costs). That option offers the same upside potential for about 10% of the cost. It’s also appealing that the total risk on this trade is the amount invested: $1,175 (plus transaction costs). Note also the differences in buying power between the two strategies (see figures 1 and 2).

The Differences Between Buying Stock vs. Buying Calls

Although the maximum upside potential is the same between buying a call option and buying the actual stock, the apples-to-apples comparison ends there. So even though the strategy is commonly known as the “stock replacement strategy,” it’s not a complete replacement.

Before jumping into options as an alternative to stock, you should know a few things:

- Break-even point. The break-even point of a call option is higher than the current stock price because of the extrinsic value (also known as time value and measured by the options greek theta) associated with a call option. Conversely, a stock doesn’t carry the risk of theta. A stock purchase becomes profitable as soon as the underlying price rises above the purchase price (after accounting for commissions).

- Risk limits. Although the stock purchase becomes profitable if the stock rallies, its downside risk is much greater—all the way to zero. The call option, however, is limited only to the premium paid minus transaction costs.

- Dividends and other rights. Dividends are paid to the stock’s owner of record as of the ex-dividend date. Owning a call option does not entitle you to a dividend. The same is true of voting rights. Stockholders retain them; option holders don’t.

- Position monitoring. When you buy a stock—particularly a long-term holding—you don’t need to monitor it daily. You may want to, depending on your objectives and risk tolerance, but it’s not required. Options, however, do require extra monitoring, especially as the expiration date approaches. If you own a call option, you need to be aware of expiration and the potential conversion of an in-the-money (ITM) option into stock.

A Note on Options Expiration and Position Management

Some action is required before expiration. If it’s out-of-the-money at expiration, you could let it expire worthless, knowing your risk was limited to the premium paid, plus transaction costs. If it’s ITM, however, you can exercise it and buy the stock—something the holder of an option can do at any time prior to expiration—but you’ll need to have enough money in your account to do so. Most standard stock options ITM by $0.01 or more at expiration will usually be automatically exercised.

You can close the trade by selling the option at any time before expiration. Another alternative is to extend the trade by rolling the existing option to an even longer-dated call. This is all in contrast to the buy-and-hold practice of purchasing long stock.

New to options expiration? Refer to this beginner’s guide.

Bonus Round: Taking Stock Replacement to the Next Level

Now that you’ve learned how to replace buying a stock with buying a long-dated call option, let’s take it a step further and learn how to reduce the net cost and theta risk of that long-dated call by selling a short-dated call option against it.

In our first example, we showed a 120-strike call option with about seven months to go until expiration. You could consider selling another call against it—perhaps a 125-strike call with one month to go for a premium of $1.75 (times 100, or $175) minus transaction costs. Now instead of having negative theta, the trade becomes a bullish diagonal spread. The risk profile of a bullish diagonal is similar to the covered call strategy. The bullish diagonal has positive theta decay—short-dated options typically decay more rapidly than long-term options—which can help offset the net cost of the long-dated call, all while working in the favor of an investor with a bullish posture.

But as with all options strategies, this one has its own trade-offs and risks. Still, it’s a defined-risk strategy. Let’s break it down.

Considering the strike prices (120 long-dated call, 125 short-dated call) in this sample trade, it’s a bullish strategy with a target price equal to the strike of the short-dated call at 125 up until the expiration of the short-dated 125-strike call. There’s still downside exposure, but it’s a fraction of the risk compared to buying 100 shares of the stock.

Plus, you could roll or close the short option prior to expiration, particularly if you think the stock might hold steady. In fact, you could implement a rolling strategy, which could be used many more times prior to the expiration of the long-dated call.

It’s a defined-risk strategy to control the overall cost of buying the long-dated call while still maintaining a long directional posture.

The Bottom Line on Buying a Call Option vs. Buying Stock

Though the stock replacement strategy has its advantages—capital efficiency and defined risk—there are differences between owning a stock and owning the right (but not the obligation) to buy it. Options aren’t for everyone. But if you want to take it to the next level, education is key.

"strategy" - Google News

April 16, 2021 at 09:15PM

https://ift.tt/3ecl81Y

Need a Replacement Strategy? Buying Stock vs. Buying Call Options - The Ticker Tape

"strategy" - Google News

https://ift.tt/2Ys7QbK

https://ift.tt/2zRd1Yo

Bagikan Berita Ini

0 Response to "Need a Replacement Strategy? Buying Stock vs. Buying Call Options - The Ticker Tape"

Post a Comment